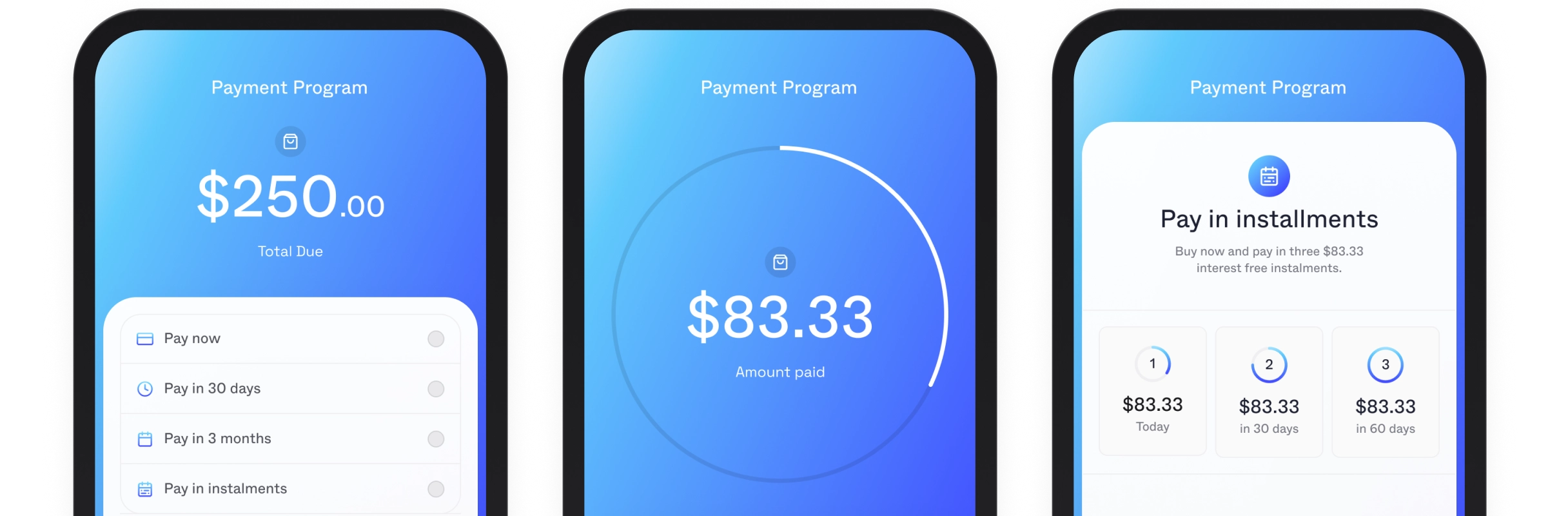

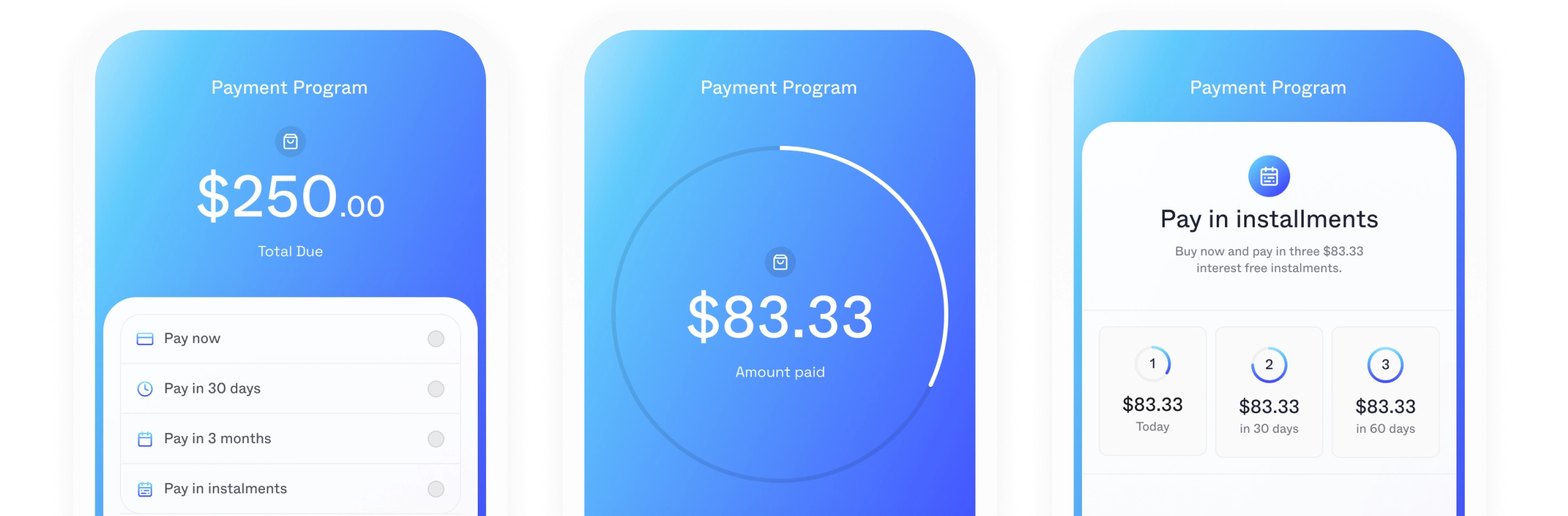

Make smarter lending decisions

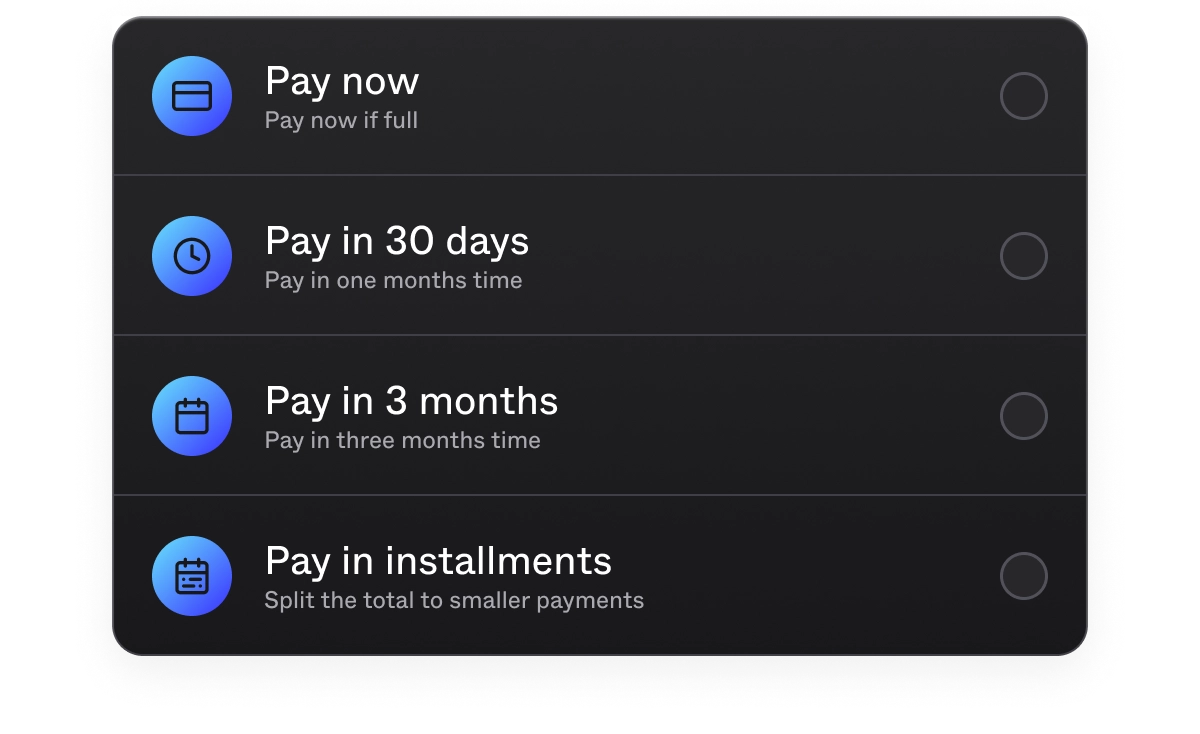

Drive higher conversion rates and customer satisfaction with flexible payment options, empowering customers to make purchases today and pay over time.

Integrate personalised loans

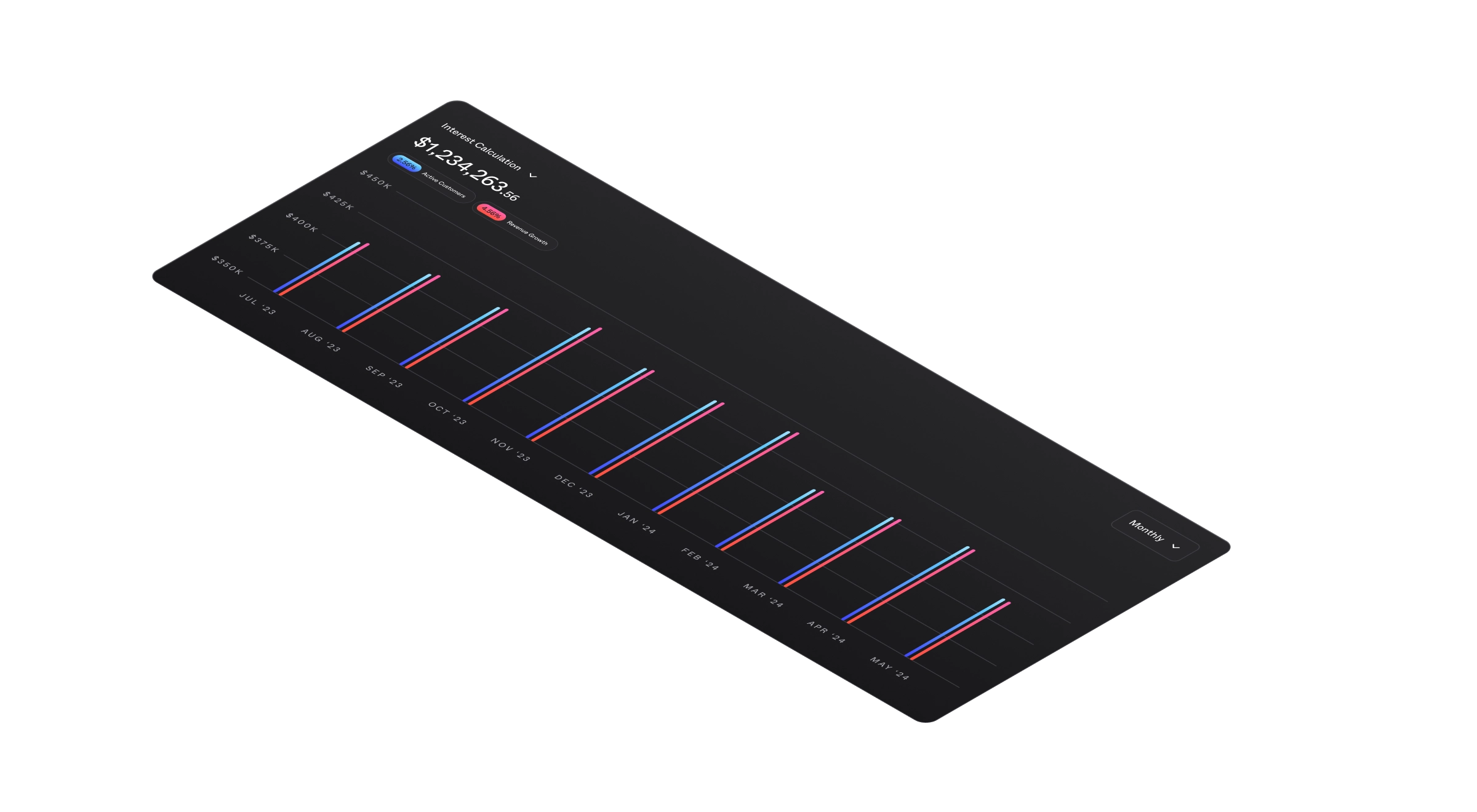

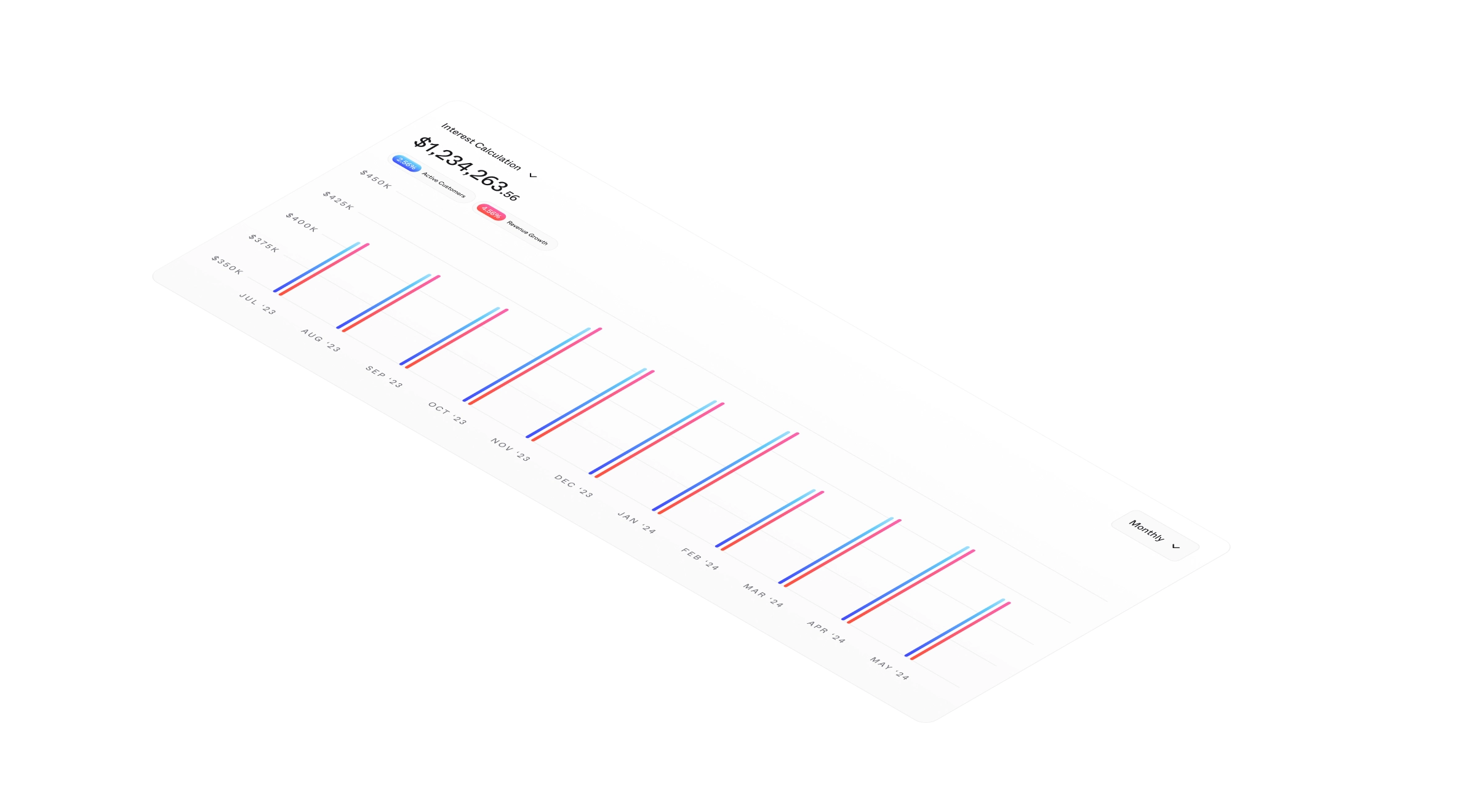

Gain real-time access to invaluable consumer bank data, enabling you to make well-informed credit and risk assessments that drive smarter lending decisions.

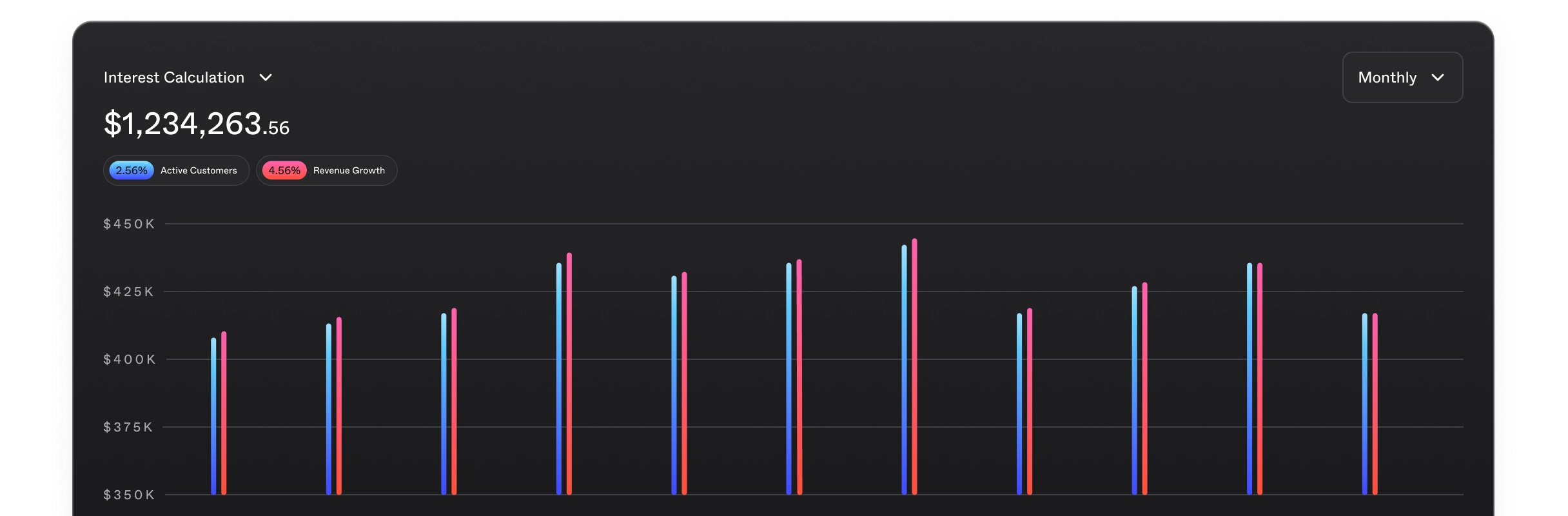

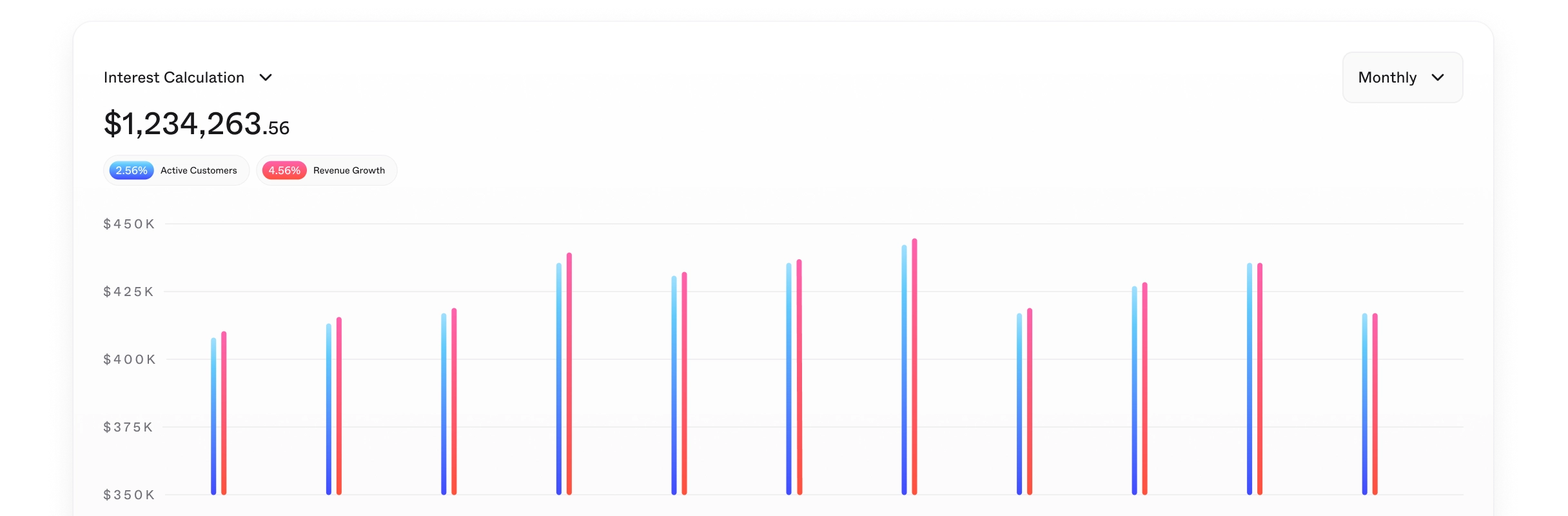

Smarter Decisions

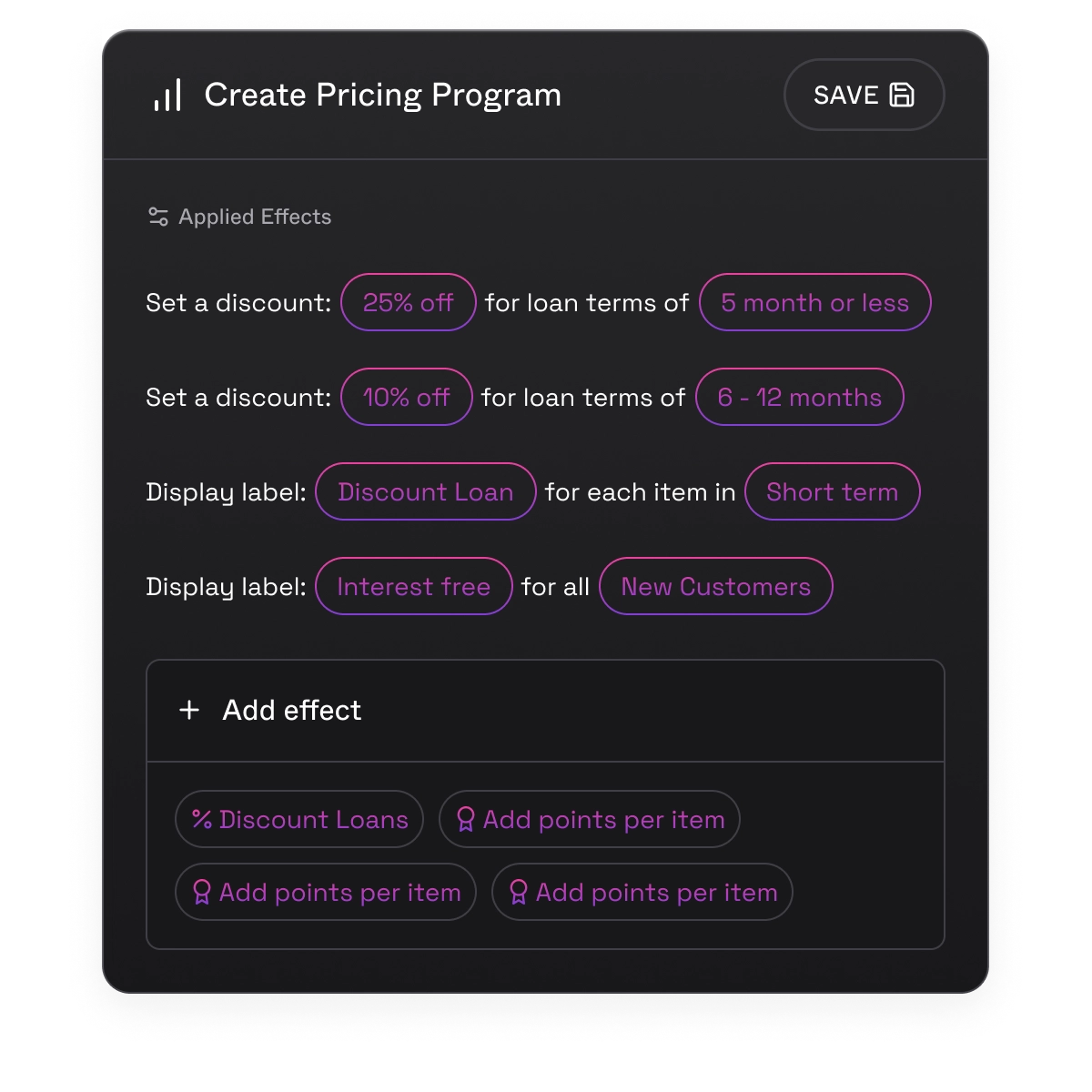

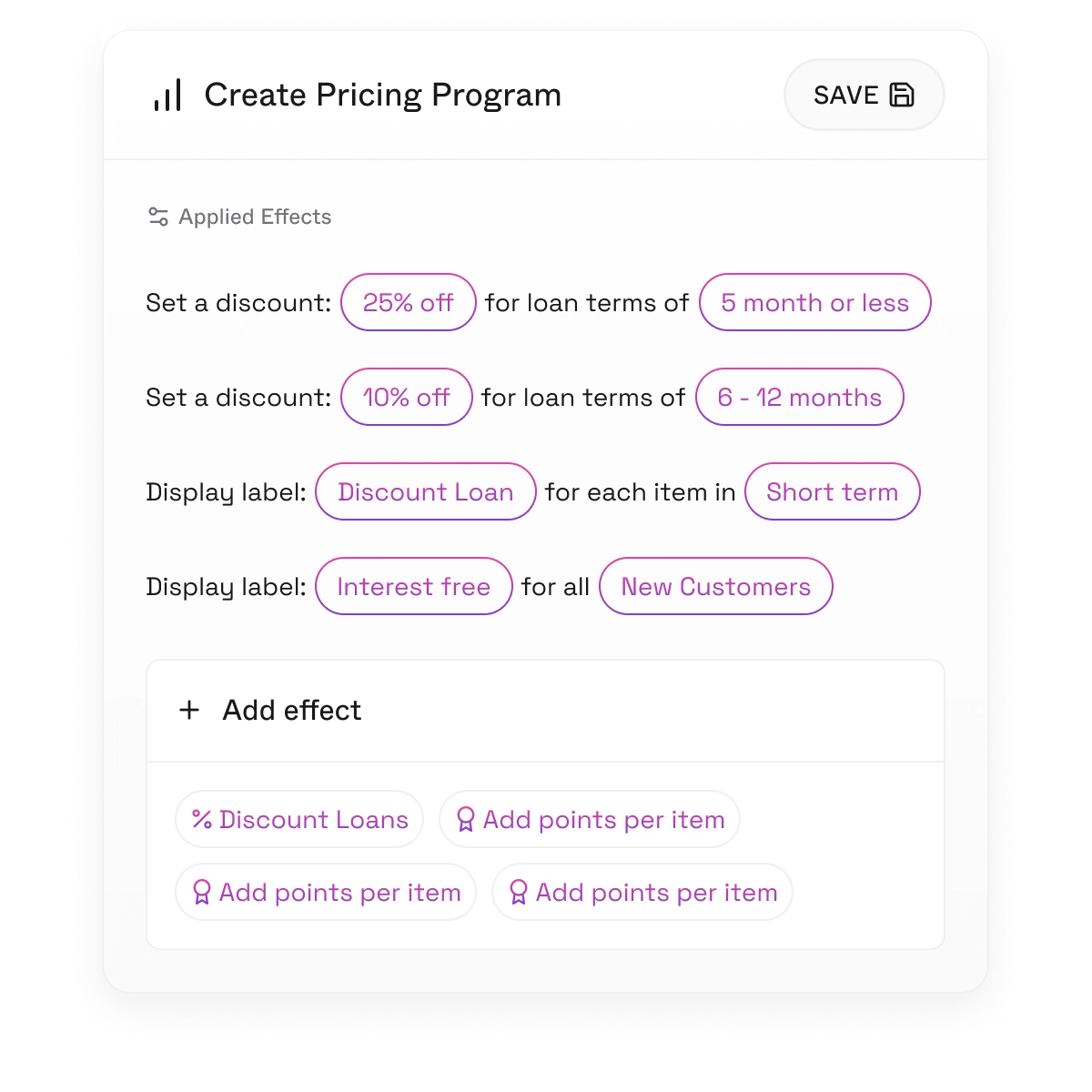

Optimize loan profitability with dynamic risk-based pricing

Frictionless Origination

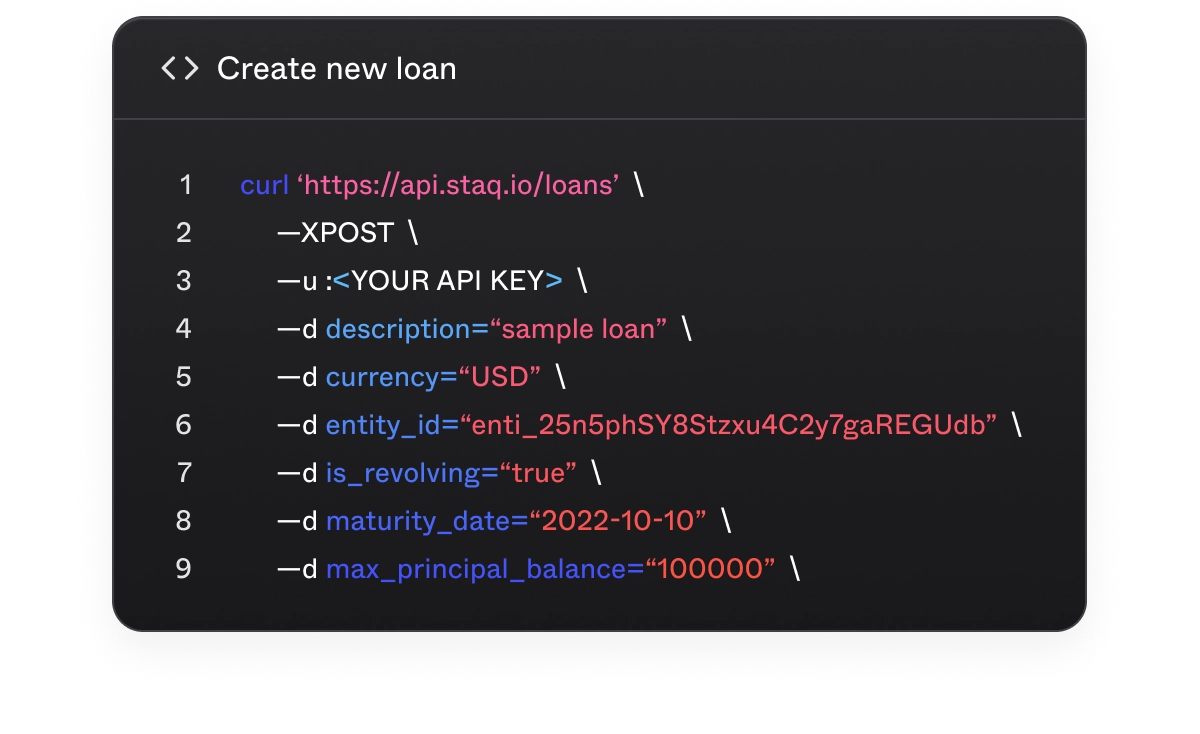

API-driven for seamless integration with third-party platforms.

Optimize Performance

Customize payment plans to fit borrowers' financial needs

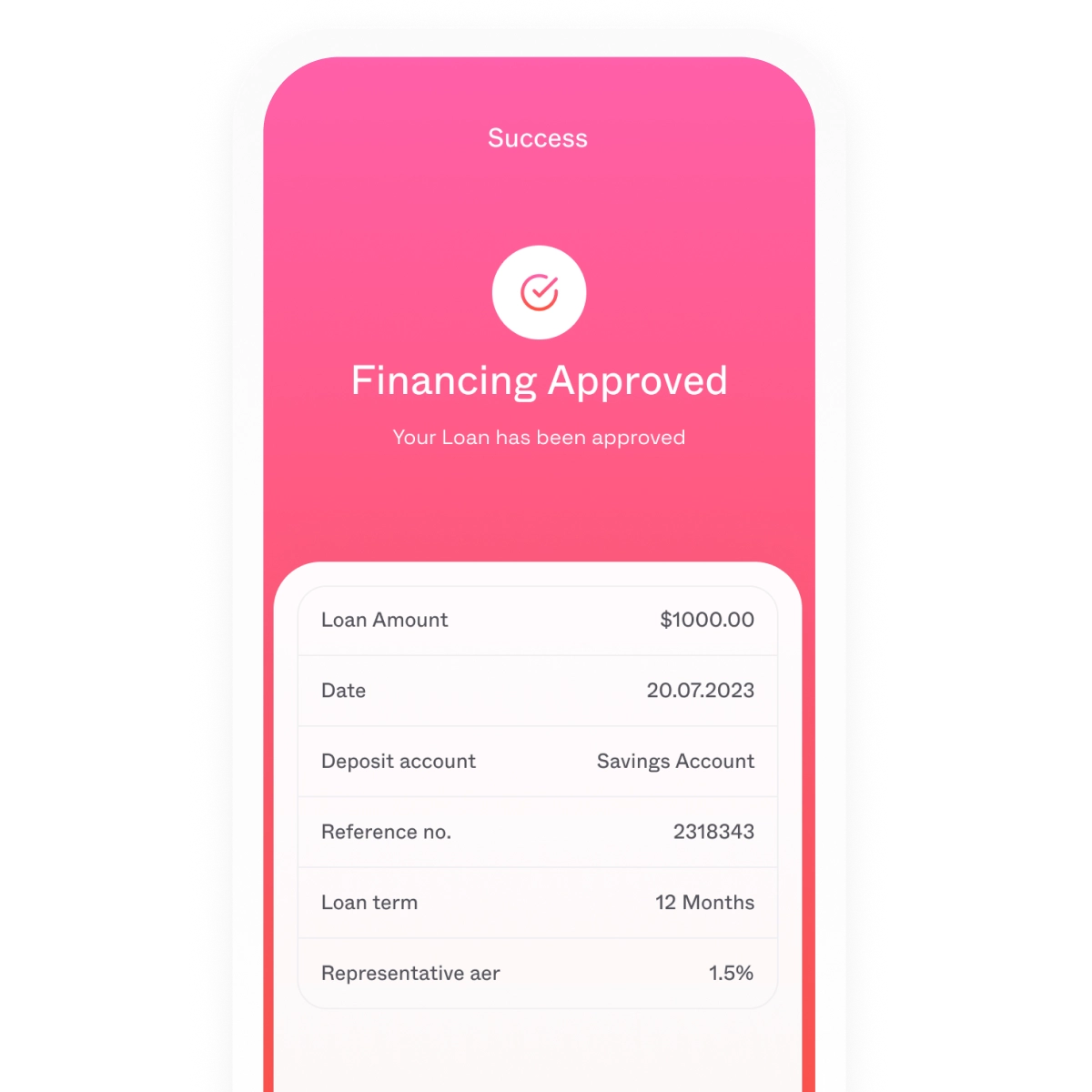

Accelerate approvals

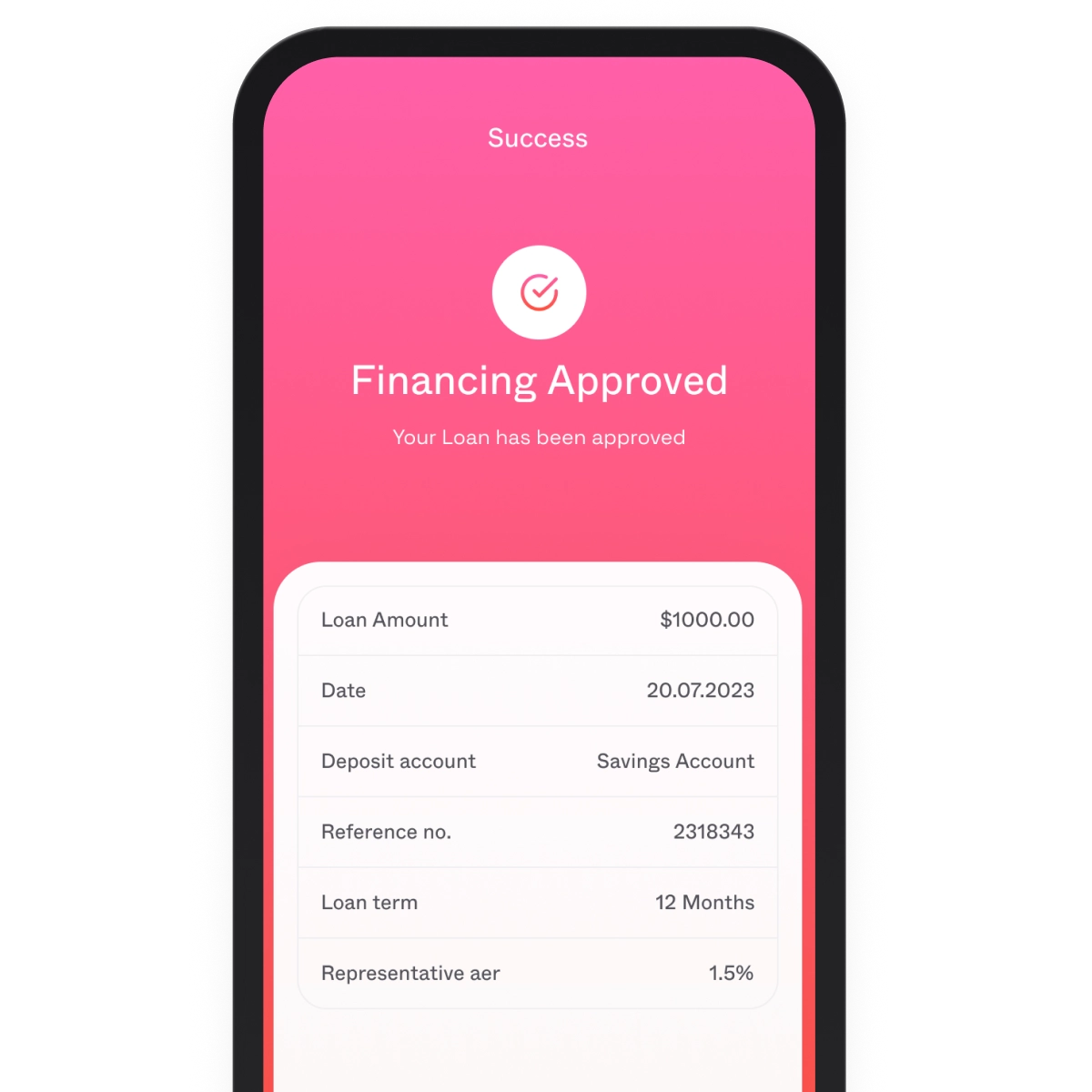

Enhance customer experience with instant loan disbursement

Lending

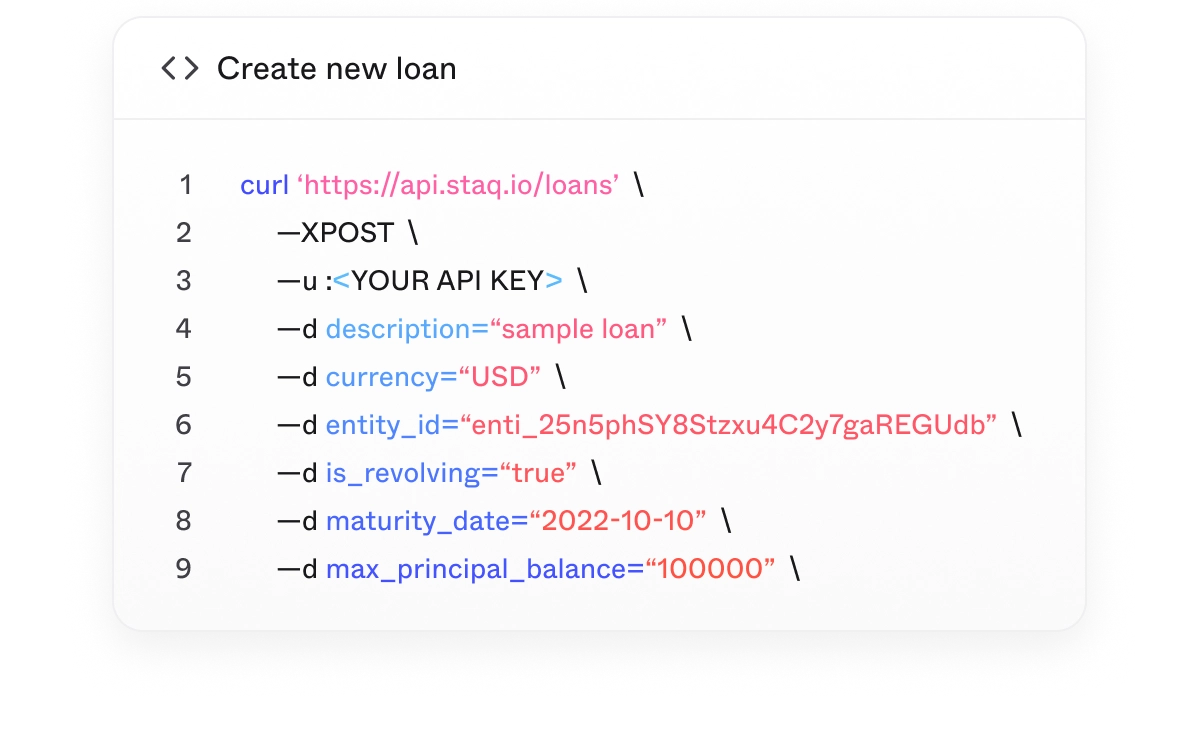

Implement seamlessly

Staq's platform helps you automate your workflows from start to finish, so you can collaborate more effectively and efficiently.

Submit Loan Request

Confirm Loan Request

curl -XPOST 'https://sandbox-api.staq.io/api/v1/tppa/users' \

--header 'Idempotency-key: 65d16950-1355-486e-8322-6002b713e0a6' \

--header 'Content-Type: application/json' \

--data '{

"Product": "Auto Loan",

"CrifConsent": true,

"PersonalDetails": { "NationalId": "9962023180", "PhoneNumber": "0795023578", "TypeOfResidence": "Owned", "WorkDetails": { "EmploymentType": "Employee", "PositionTitle": "Specialist", "CompanyName": "Bank Al Etihad", "Sector": "Private", "EmploymentStartDate": "01/08/2015", "BusinessLine": "Bakery", "NetSalary": 2000 }, "LoanDetails": { "LoanAmount": 2020, "LoanTerm": 60, "InstallmentDay": 25, "CarDetails": { "CarType": "Car", "CarMake": "Honda", "CarModel": "Civic", "CarCondition": "Used", "YearOfManufacture": "2020", "FuelOption": "Fuel", "CarPrice": 20000, "DealershipName": "Obaidi" } } }

}'